Discount Coupon Credit cards Credit Card Compare Advantages benefits of Credit cards

Best Credit cards: Get Great Rates Every Time with Taptap Send + Taptap Send offers a convenient, secure and fast way to transfer money to your loved ones. With our easy-to-use app, you can send funds directly from your smartphone to Africa, Asia, the Caribbean and Latin America. just a few taps and a debit card are required, eliminating complicated lines and fees. rest assured that your transfers reach their destination with ease. More countries will be available soon! download Taptap Send and enjoy great rates every time.. Find out how to choose the best credit card for your needs. Exclusive tips to save and gain benefits. Compare now and order yours now! Earn miles, CASHBACK and other exclusive benefits with the best credit cards on the market. Compare now and order yours without annuity! Credit Card for Negative? Even with restrictions on the CPF, it is possible to have a credit card. Learn about the options available for negatives and learn how to request yours right now!

Best Credit cards Promo Code · Credit cards Discounts & History

Credit cards Discount Coupon : Compare the best credit cards and enjoy the exclusive advantages and benefits offered by each Credit cards credit card option, with exclusive discounts! Discover the options without annuity, with CASHBACK, international, negative and prepaid, and choose the one that best suits your needs and financial goals. Don't waste any more time and start enjoying all the advantages that your credit card can offer, with special discounts for Credit cards!

The Credit cards credit card is an electronic payment method that allows the user to make purchases at physical or virtual establishments, without the need to pay in cash. This type of card works as a line of credit offered by financial institutions, where the user can spend a certain amount within the established credit limit, being charged later with interest if the invoice is not paid in full.

In addition to being a practical and convenient way of making payments, the Credit cards credit card offers other advantages to its users, such as the possibility of paying for purchases in several installments, participating in reward programs and accumulating points that can be exchanged for products or services. However, it is important to point out that using a credit card requires financial planning and control, to avoid excessive indebtedness and the high interest charged in case of late payment of the invoice. To acquire a credit card, it is necessary to request the issuance from a financial institution, such as a bank or credit card company. The approval process may vary according to the applicant's profile, taking into account factors such as income, credit history and other registration data. It is important to highlight that the credit card is not suitable for all consumer profiles, especially for those who have difficulty controlling their expenses or have an unstable income. In these cases, it is recommended to use other forms of payment, such as cash or direct debit from a current account. In summary, the Credit cards credit card is a useful tool for those looking for practicality and convenience in their purchases, but it must be used responsibly and with financial planning to avoid debt problems and high interest rates.

- All

- Top Offers

- Promo codes

- % Discount

- $ Discount

- Free shipping

- Deals

Special offer: first 3 transfers free

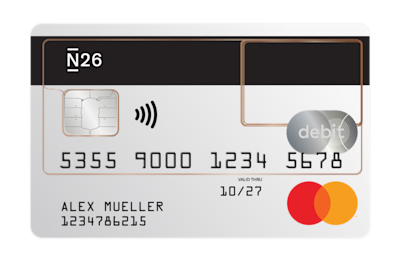

Save more by choosing the right debit card

Save even more with free debit cards like Wise and N26. They help you avoid extra fees, manage online payments, and shop more efficiently, especially at international stores.

Send Money with Taptap Send!

Limited Time Deal: Sometimes Free Money Transfers

Send money abroad with low fees at Taptap Send

Exclusive Offer: Send Money Abroad with Zero Fees!

First Transfer Free

First Transfer Free!

Special Offer: Transfer Money with Low Fees

Credit Card Complete Guide for Credit cards

Welcome to the comprehensive guide to understanding credit cards and making informed financial decisions. In this guide, we will cover everything you need to know about credit cards, from their basic functionality to choosing the right card for your needs, managing your credit limit, and avoiding debt. Let's dive into the world of credit cards.

Chapter 1: Introduction to the world of Credit cards

A credit card is a powerful financial tool that allows you to make purchases without using cash. This chapter introduces you to the history and significance of credit cards, emphasizing their convenience and global acceptance. However, it's crucial to understand that a credit card is not free money but rather a line of credit that must be repaid.

Chapter 2: How Credit Cards Work Credit cards

In this chapter, we delve into the mechanics of credit cards. Learn how credit card transactions work, how credit limits are determined, and how you receive and pay your credit card bills. Understanding these fundamentals is essential to avoid late fees and interest charges.

Chapter 3: Types of credit cards available Credit cards

Credit cards come in various flavors, each tailored to different needs and lifestyles. Explore the different types of credit cards, from basic cards for building credit to rewards cards that offer perks like cashback or travel benefits. Choose the one that aligns with your financial goals and spending habits.

Chapter 4: How to Choose the Best Credit Card Credit cards for Your Needs

Selecting the right credit card requires careful consideration. This chapter provides you with tips to evaluate your spending habits, compare fees and charges, check your credit history, and consider additional benefits. Making an informed choice will ensure your credit card suits your financial needs.

Chapter 5: How to apply for a credit card Credit cards

Applying for a credit card is straightforward, but approval can take time. This chapter outlines the steps to apply for a credit card, including checking your credit history, selecting the appropriate card, filling out the application, waiting for approval, and activating your card. Remember that multiple applications at once can impact your credit history.

Chapter 6: Understanding Credit Card Fees and Charges

Credit cards often come with fees and charges that can affect your finances. This chapter helps you understand these costs, including annual fees, interest rates, transaction fees, and late payment fees. Being aware of these fees will help you manage your credit card more effectively.

Chapter 7: How to Manage Your Credit Limit Credit cards

Effective management of your credit limit is vital for responsible credit card use. Learn strategies for staying within your limit, monitoring your spending, making timely payments, and requesting credit limit increases when necessary. Responsible credit limit management is crucial for maintaining a healthy financial outlook.

Chapter 8: How to Avoid Credit Card Debt Credit cards

Credit cards can be a double-edged sword, offering convenience but potentially leading to debt if used imprudently. This chapter offers valuable tips for using your credit card wisely, including limiting usage, paying bills in full, avoiding minimum payments, setting budgets, and monitoring expenses. These strategies will help you steer clear of excessive credit card debt.

By following the advice and information in this guide, you can harness the benefits of credit cards while minimizing the risks associated with them. Remember that responsible credit card use can enhance your financial well-being and provide you with valuable financial flexibility.

Stay tuned for the remaining chapters of this comprehensive credit card guide, which will equip you with the knowledge and tools to make smart financial decisions.

FAQ

What are Credit cards's best coupon codes for February?

Get Great Rates Every Time with Taptap Send

Send more, spend less with Taptap Send

Special offer: first 3 transfers free

Send Money with Taptap Send!

Credit cards has great savings and deals

How do I use Credit cards coupons?

To use a Credit cards coupon, copy the related promo code to your clipboard and apply it while checking out. Some Credit cards coupons only apply to specific products, so make sure all the items in your cart qualify before submitting your order. If there's a brick-and-mortar store in your area, you may be able to use a printable coupon there as well.

Does Credit cards currently have discount coupons?

Yes, 1001couponcodes.co.nz currently offers 2 valid discount coupons for the Credit cards store.

How much can I save on Credit cards?

It depends on the coupon you use. 1001couponcodes.co.nz has the best options in addition to exclusive offers.

How to find the best deal on Credit cards?

You can manually copy and try all 2 available promotional codes to find the best discount, plus you can accumulate the discount coupons with our selection of promotions and 8 offers.

What is an Credit cards discount code?

An Credit cards discount code is an alphanumeric code which, like coupons or paper discount vouchers, allows you to receive a fixed discount or a percentage discount on your purchase. So, in addition to the affordable prices and offers already available on Credit cards, you can get an additional discount on the total of your cart or on shipping.